How Homeowners Can Benefit from Renewable Energy Incentives

Empowering Your Home: Unlock Renewable Energy Incentives for

Solar & Battery Solutions in NH, MA, VT & ME

Living in New England offers the unique experience of enjoying all four seasons, each bringing its own beauty and challenges, especially when it comes to managing the rising costs of fuel and energy usage in our homes. Many residents and business owners are increasingly aware of these seasonal impacts on energy costs, which is one reason why renewable energy solutions like solar panels and battery storage systems are gaining popularity. Not only do these solutions offer environmental benefits, but they also come with significant financial incentives that can help make them more affordable. Understanding these incentives can be complex, but it's essential for making informed decisions about renewable energy investments. Let's explore the federal, state, and local incentives that make renewable energy upgrades accessible and affordable for homeowners.

State & Local Incentives: A Closer Look By State

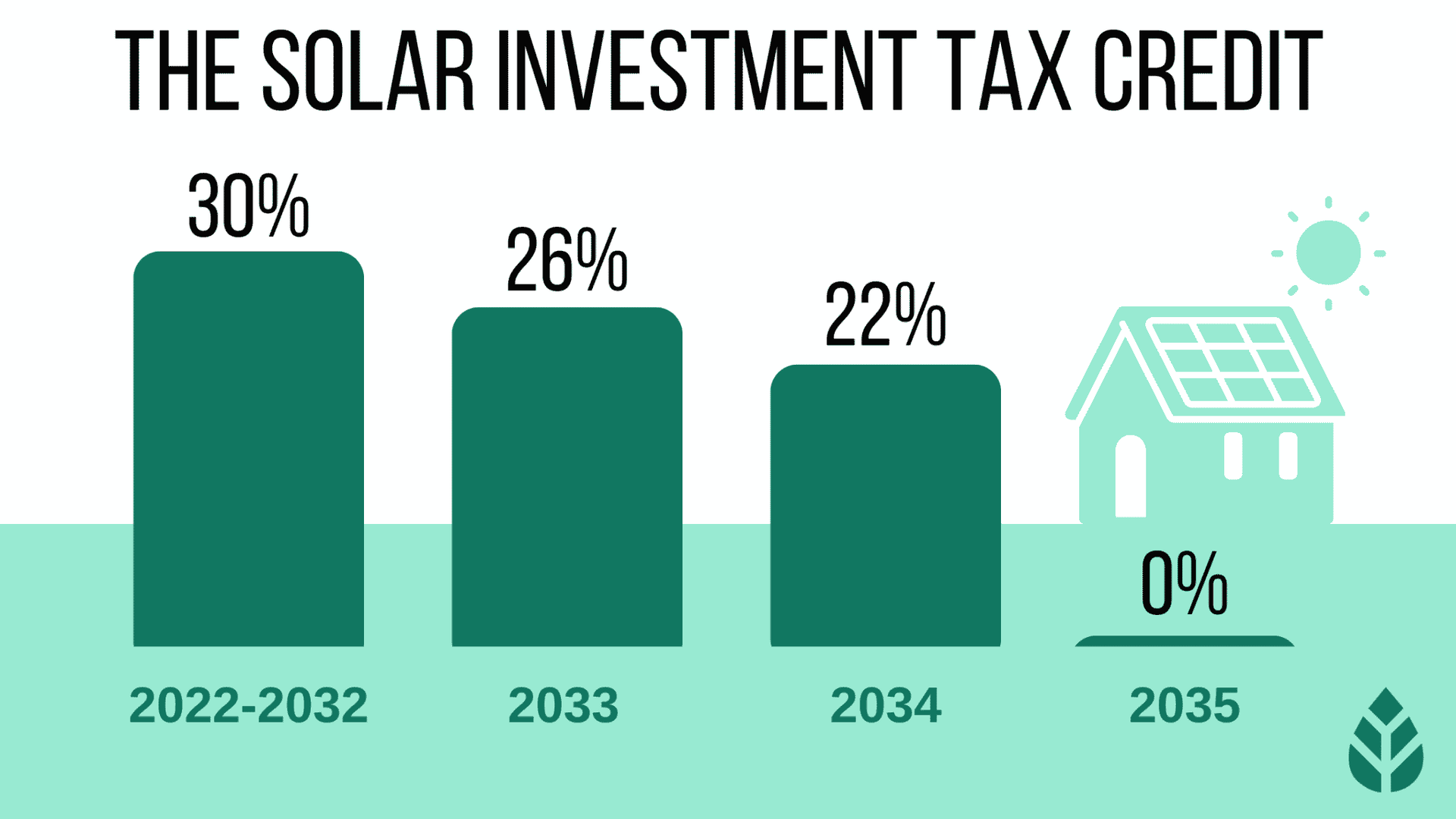

Incentives vary by region and include state tax credits, direct rebates, net metering, and property and sales tax exemptions

reducing the net cost of solar systems*

- State Tax Credits: No additional state tax credit for solar currently exists.

- Rebates and Grants: The Residential Renewable Electrical Generation Rebate Program offers rebates of up to $1,000 or 30% of system cost, whichever is less.

- Net Metering: Available in New Hampshire, allowing homeowners to sell excess solar energy back to the grid and reduce their electricity bills.

- Property Tax Exemptions: Most municipalities offer property tax exemptions for the increased value of your home due to solar panels.

Sources:

NH Public Utilities Commission: https://www.puc.nh.gov/ - Regulates utilities in the state.

NH Office of Energy and Sustainable Planning: https://www.energy.nh.gov/ - Provides information on energy programs and incentives.

New Hampshire Solar Energy Association: https://www.nhasea.org/contact-us/ - Non-profit promoting solar energy use.

- State Tax Credits: A separate state tax credit for solar can further reduce system costs.

- Rebates and Grants: Several programs offer rebates and grants for solar installations, with a focus on low-income residents.

- Net Metering: Net metering is available in Massachusetts with generous compensation for excess solar production.

- Property Tax Exemptions: Similar to New Hampshire, most municipalities exempt the increased value from solar panels from property taxes.

Sources:

Mass. Department of Public Utilities: https://www.mass.gov/orgs/department-of-public-utilities - Regulates utilities in the state.

Mass. Clean Energy Center: https://www.masscec.com/ - Offers resources on solar programs and financing.

Mass. Executive Office of Energy & Environmental Affairs: https://www.mass.gov/orgs/executive-office-of-energy-and-environmental-affairs - Provides information on energy programs and incentives.

- State Tax Credits: A state tax credit exists alongside the federal ITC.

- Rebates and Grants: Rebates are available through the Maine Renewable Energy Trust Fund.

- Net Metering: Net metering is available in Maine with a net metering billing option.

- Property Tax Exemptions: Property tax exemptions are available for the increased value of your home due to solar panels.

Sources:

Maine Public Utilities Commission: http://www.maine.gov/mpuc/home - Regulates utilities in the state.

Maine Renewable Energy Association: https://www.renewablemaine.org/ - Non-profit promoting solar energy use.

Maine Governor's Energy Office: http://www.maine.gov/energy/home - Provides information on energy programs and incentives.

- State Tax Credits: No additional state tax credit for solar currently exists, but residents can take advantage of the federal ITC.

- Rebates and Grants: Several programs offer rebates for solar installations, with a focus on low-income residents and specific technologies.

- Net Metering: Net metering is available in Vermont with a net metering billing option.

- Property Tax Exemptions: Property tax exemptions are available for the increased value of your home due to solar panels.

Sources:

Vermont Public Service Department: https://publicservice.vermont.gov/ - Regulates utilities in the state.

Vermont Energy Investment Corporation (VEIC): https://www.veic.org/ - Provides financing and technical assistance for renewable energy projects.

Dept. of Public Service - Public Advocacy Division: https://publicservice.vermont.gov/ - Represents consumer interests in utility matters.

Utility Company Incentives

Utilities may offer rebates and performance-based incentives for solar power and battery storage, further reducing costs. You can find your local utility by entering your zip code on the website of your state's Public Utilities Commission (links provided above). The utility company website will typically have information on any solar-related programs or incentives they offer.

Using Rewiring America’s Calculator

Rewiring America’s Household Electrification Incentives Calculator helps homeowners calculate potential savings and incentives based on their specific situation. This tool can help you determine the financial feasibility of solar upgrades by estimating cost reductions, tax credits, and utility savings.

A Bright Future for Solar Energy & Battery Backup Power!

Homeowners can significantly benefit from the extended 30% federal tax credit and explore additional incentives. By using tools like Rewiring America’s calculator, they can obtain personalized insights into how renewable energy can be financially advantageous.

Ready to see what savings you could achieve? Check your potential incentives with Rewiring America's Calculator:

https://homes.rewiringamerica.org/calculator

General Resources:

Database of State Incentives for Renewables & Efficiency (DSIRE): https://programs.dsireusa.org/system/program/detail/1235 - Excellent resource for researching state-by-state incentives.

Energy Star Solar Energy Incentives: https://www.energystar.gov/ - Provides an overview of federal solar incentives.

Contact Us